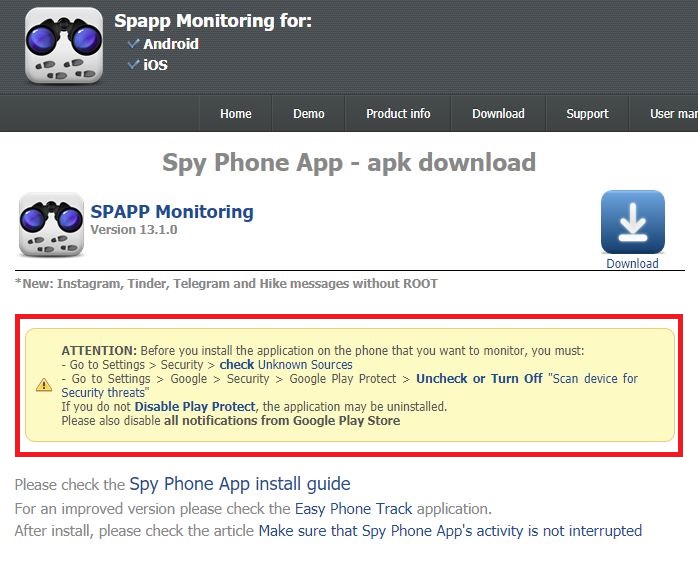

British taxpayers have been targeted in a new form of phishing attack from fraudsters who claim to be HM Revenue and Customs officials.

As the deadline for online self assessment approaches, Revenue and Customs officials have warned of an unprecedented increase of false email messages and telephone calls purporting to come from the government office.

The emails, of which 11,000 are believed to have been circulated, tell would-be tax payers that they qualify for a refund on their tax bill and ask for bank and credit card details to enable payment of the fictitious refund. In some cases, scammers have even attempted to contact individuals by telephone, posing as representatives of HMRC.

Customers who provide their details are exposed to the risk of theft from their bank accounts and having their details sold to organised criminal gangs.

Lesley Strathie, from HM Revenue and Customs advised that HMRC would never contact taxpayers by email regarding a possible overpayment.

“This is the most sophisticated and prolific phishing scam that we have encountered. We only ever contact customers who are due a refund in writing by post. We never use emails, telephone calls or external companies in these circumstances. I would strongly encourage anyone receiving such an email to send it to us for investigation.”

Officials said attempts to dishonestly gather personal information were likely to continue after the January 31 self-assessment deadline had passed.